Opportunity Zones

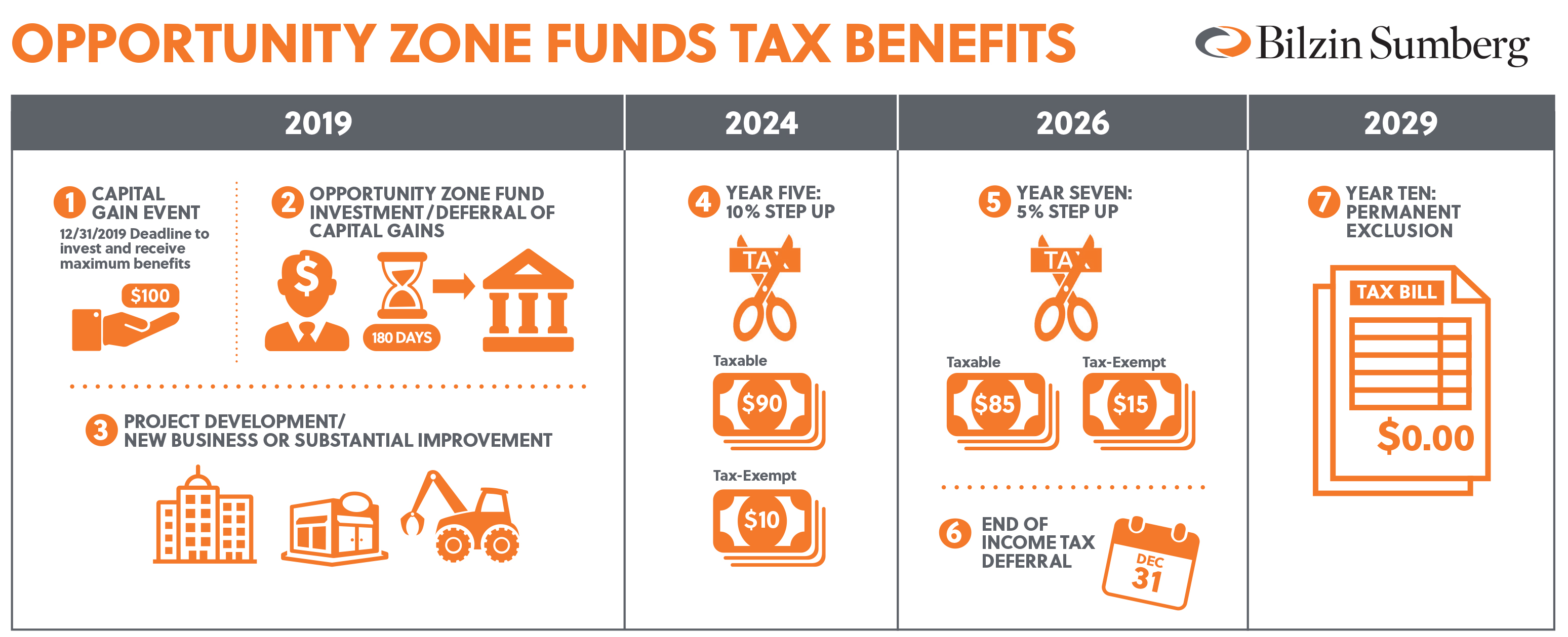

The Opportunity Zone rules promulgated in December 2017 offer investors significant tax benefits for investments in certain low-income communities. Investments in Opportunity Zones receive three primary tax benefits. First, taxpayers can elect to defer capital gains by investing them in qualified Opportunity Zone funds within 180 days of recognition of the gain. If the taxpayer maintains its investment in the fund, this gain will become payable in 2026. Second, subject to certain timing requirements, the underlying basis of the original capital gain will receive a 10% step-up after the taxpayer holds the gain in the fund for 5 years, and an additional 5% step-up if the taxpayer holds the gain in the fund for 7 years. Finally, if the taxpayer maintains its investment in the fund for 10 years, the taxpayer will receive a step-up in basis equal to the fair market value of the investment.

However, as implementing regulations continue to be developed by the IRS, investors and fund managers face regulatory uncertainty with respect to key aspects of opportunity zone investment. At Bilzin Sumberg, we believe in a comprehensive, interdisciplinary approach to tackling this new regulatory regime. We have formed a cross- departmental team of experts from our tax, fund formation, joint venture, securities laws/capital markets, real estate and project development and finance groups to advise clients through all stages of an Opportunity Zone investment, from fund formation, to operations, to divestiture. In the short time since the Opportunity Zone rules were promulgated, we have represented clients with respect to $100 million in real estate projects in Florida and Connecticut, including:

- acting as counsel to fund managers on the formation, structuring, and regulatory compliance of qualified Opportunity Zone funds, the preparation of private placement memoranda, and the closing of capital contributions;

- acting as counsel to investors and real estate owners in the creation of single-purpose, single-owner funds for investment into specific projects; and

- advising clients on risk mitigation measures in light of regulatory uncertainty, including with respect to corporate structuring and disclosure issues (in particular, risk factor disclosure).

The attorneys at Bilzin Sumberg have been closely following the Opportunity Zone program since its inception, and we look forward to working with you to achieve your investment goals.