Joint Ventures

"I am very impressed and delighted with the advice provided by Bilzin. The firm's high deal flow provides them with unique and diverse experience which leads to multiple possible solutions to any issues that arise."

- CHAMBERS USA

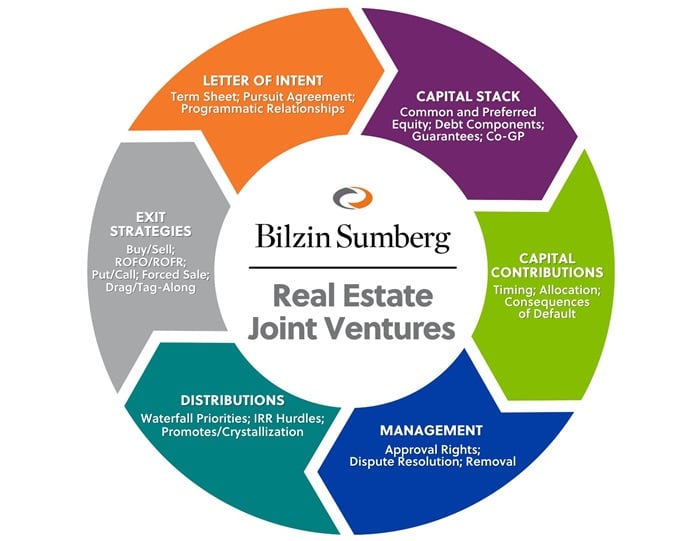

Bilzin Sumberg’s Joint Venture practice stands out for its industry-recognized expertise in structuring, negotiating and documenting complex real estate joint ventures in Florida and across the country. The firm’s joint venture attorneys have represented developers, sponsors, and equity investors in joint ventures that have involved every type of real estate asset, including multifamily, commercial, condominium, retail, office, hospitality, mixed-use and industrial. With one of the most sophisticated joint venture practices in Florida, Bilzin Sumberg regularly advises on joint ventures valued in the hundreds of millions – sometimes billions - of dollars, and many of which formed to develop landmark buildings and projects. Common areas of counsel include capital stack composition (including preferred equity transactions and part-sale, part-contribution transactions), governance (single manager, multiple managers, executive committee, etc.), complex tiered distribution waterfalls, alternative forms of exit strategies, dispute resolution and creative tax strategies.

Going beyond the legal considerations of each transaction, Bilzin Sumberg’s joint venture attorneys leverage their advanced degrees in taxation and their deep knowledge of Florida’s real estate market and those in other parts of the country to render tailored, strategic and often-times creative counsel that touches upon each client’s unique business plans and long-term goals. Bilzin Sumberg’s joint venture practice is further strengthened by various complementary legal specialties all housed out of the firm’s single Miami office that can comprehensively serve developers’ and investors’ real estate needs, from acquisitions and financing, to land use, zoning, construction, environmental, and tax-related matters.