Live Local Act Rent: 2024 Limits Increased by up to 10%

The Florida Housing Finance Corporation (“FHFC”) recently published their 2024 Income Limits and Rent Limits. These figures show up to a 10% increase in rent limits applicable to qualified Live Local Act projects throughout all of Florida.

The Florida Housing Finance Corporation (“FHFC”) recently published their 2024 Income Limits and Rent Limits. These figures show up to a 10% increase in rent limits applicable to qualified Live Local Act projects throughout all of Florida.

The Live Local Act provides significant zoning benefits if at least 40% of the residential units in a multifamily development are dedicated to attainable rental housing of 120% Area Median Income (AMI), or less. Qualifying Live Local Act projects can obtain the following zoning benefits via administrative approvals: (1) increased density to the highest allowed density in the local municipality; (2) increased height to the highest allowed height in the local municipality within a mile of the qualifying project; (3) increased floor area ratio to 150% of the highest allowed floor area ratio in the local municipality; and, (4) significant parking reductions.

Additionally, the Live Local Act also provides significant tax exemptions if 71 or more units in a multifamily development are dedicated to attainable housing of 120% AMI or 90% of fair market value rent, whichever is less. Qualifying projects receive a 75% tax exemption for the assessed value of qualifying units dedicated to attainable housing of 120% AMI and 100% tax exemption for units at 80% AMI.

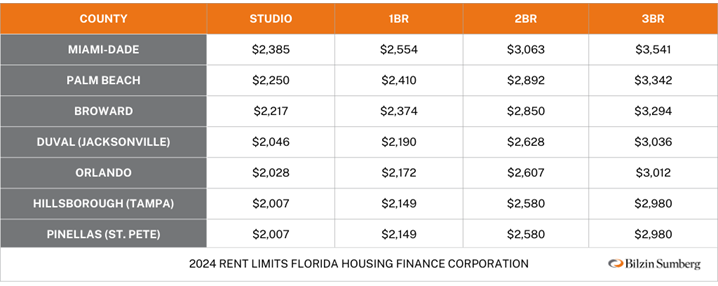

These new rent and income limits, combined with the increased zoning and tax benefits, as approved by the Florida Legislature in the Live Local Act 2024 in Senate Bill 328 (SB328) (read more about those changes here), provide significant incentives for the development of attainable workforce housing across the State. Below is a summary chart for the new 2024 120% AMI rent limits for the major cities in Florida. Should you be interested in understanding more about the Live Local Act 2024, or how these rent limits are applied, please do not hesitate to contact the authors of this update for the latest on the topic.